The market report published in October by real estate analyst Propertymonitor contains a number of interesting market data that are of great value for an assessment of the status quo of the Dubai real estate market – but especially with regard to a qualified assessment of the market development to be expected in the medium term.

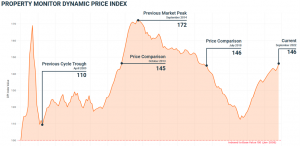

The “Dynamic Price Index” for example tracking market price development in the residential sector, stands at an index value of 146 in September 2022 (corresponding to an average purchase price per square meter of EUR 3,030) and is thus at the same level as in July 2018.

In other words, while real estate prices in Dubai have already risen sharply from the cyclical market low at the end of 2020, the previous high of September 2014 (index value 172) is still a long way off.

Equity vs. Debt

It is also interesting to note that the total transaction volume has once again increased significantly in recent months, with transactions executed in the first three quarters of 2022 already exceeding the number of transactions for the full year 2021 by 11.9%.

This is particularly remarkable in the context of the sharp rise in mortgage interest rates in recent months, as these are known to curb the purchase demand for real estate.

Thus, the volume of real estate loans granted by local banks decreased by 8.7% in September, while the average interest rate (fixed for three years) now stands at 4.49%, a whopping 2% higher than twelve months ago.

The fact that the reduction in available debt capital in an environment of rising financing rates has been more than offset by the net inflow of investment and equity capital is remarkable and good news for Dubai as a real estate investment destination.

Low Vacancy Rates – High Rental Yields

Another noteworthy development is the average gross rental yield achievable with real estate in Dubai. As a ratio between property purchase price and achieved yearly rental income, this key figure is valuable, among other things, for assessing the attractiveness of the market in an international comparison.

For September 2022, Property Monitor recorded the highest gross rental yield in the past three years at 6.51%, which allows further interesting conclusions to be drawn about the status of the market.

First, Dubai’s population shows an increase of a good 4%, or 140,000 people, for the two years from July 2020 (source: Dubai Government).

As this influx and the resulting demand for housing was not matched by an adequate supply of new properties, the aforementioned increase led to an increase in rental occupancy and, as a result, a substantial rise in market rents achievable throughout the emirate.

On the other hand, the rise in financing interest rates led to potential owner-occupier property buyers penting up demand in the rental market, further reinforcing the trend of rising rents and rental yields.

Segments: Apartments with Catch-up Potential, Off-plan Properties Interesting

For the reporting month of September, the price index tracking the entire residential property market shows a significant increase of 2.06%, while no significant price increases or decreases had been recorded since April 2021.

A detailed look at the basic data reveals that the aforementioned development is essentially due to rising prices for apartments in B and C locations, among others.

It is a fact that the real estate segment of apartments (especially in A and B locations in Dubai) has lagged significantly behind townhouses and villas in terms of price development since the start of the new cycle in 2020.

It therefore seems plausible that the renewed dynamization that is now observed could mark the beginning of a new market phase characterized by disproportionate price increases for apartments.

Considering the aforementioned, current market data as well as the inflation trend, we consider selective investments in off-plan properties in suitable locations and price ranges – especially in the mid-range segment and using attractive payment plans – to be particularly interesting.

Conclusion

The gross rental yield, which has just climbed a three-year high, shows two things: On the one hand, real estate in Dubai – despite the positive price trend of the past two years and in terms of the income generated – is extremely favorably valued and highly attractive by international standards.

The fact that the dwindling supply of debt capital under the influence of rising borrowing rates has now been replaced by equity capital flowing into the market may also be taken as evidence of this.

On the other hand, the development in yields cited confirms a sustained strong demand for rental space, fueled by dynamic immigration trends.

The development of the market-wide price index, which despite the recent price surge still shows a gap of around 18% compared with the all-time high for the Dubai real estate market recorded in April 2014, also fits into this picture.

Outlook

Against the backdrop of accelerating global inflation and the deep recession looming in Europe and other established markets, we expect the flight to real estate in viable locations such as Dubai to continue and even accelerate.

It is obvious that Dubai – as a fully established international trading center and an equally innovative and neutral location in the emerging multilateral world order – will be able to benefit disproportionately from this development.